How BI Tools Help You Control Bubbles: Navigating Market Volatility

In today’s fast-paced financial landscape, the term “bubble” is more than just a buzzword; it’s a harbinger of potential market instability. From the dot-com boom to the recent cryptocurrency surge, history is replete with instances where inflated asset values ultimately led to significant financial downturns. Understanding and mitigating the risks associated with these bubbles is crucial for investors, businesses, and policymakers alike. This is where Business Intelligence (BI) tools come into play, offering a powerful arsenal of analytical capabilities designed to help you control bubbles by providing insights into market trends, identifying early warning signs, and enabling data-driven decision-making. This article delves into how BI tools help you control bubbles and navigate the complexities of market volatility.

Understanding the Anatomy of a Bubble

Before we explore how BI tools help you control bubbles, it’s essential to understand the cyclical nature of market bubbles. Bubbles typically follow a predictable pattern, often characterized by:

- Initial Displacement: An external shock, such as a technological innovation or a shift in economic policy, sparks investor interest.

- Expansion: Rising prices attract more investors, fueled by speculation and a fear of missing out (FOMO).

- Euphoria: Market participants become overly optimistic, ignoring warning signs and rationalizing high valuations.

- Profit Taking: Early investors begin to sell their assets, triggering a decline in prices.

- Panic: The decline accelerates as investors rush to exit the market, leading to a crash.

Identifying these phases in real-time is critical for effective risk management. BI tools provide the analytical horsepower to dissect market data and identify the subtle shifts that signal the formation and potential bursting of a bubble. They are instrumental in helping you control bubbles.

The Role of BI Tools in Bubble Control

BI tools offer a range of functionalities that are invaluable in helping you control bubbles. These capabilities include:

Data Aggregation and Integration

BI tools excel at consolidating data from various sources, including financial statements, market data feeds, social media, and news articles. This integrated view allows for a comprehensive understanding of market dynamics and the factors influencing asset prices. The ability to access and analyze diverse datasets is a cornerstone of how BI tools help you control bubbles.

Real-time Monitoring and Alerting

Real-time monitoring is crucial for identifying emerging trends and potential risks. BI tools enable the creation of dashboards and alerts that track key performance indicators (KPIs) and flag anomalies. For example, a sudden surge in trading volume or a divergence between asset prices and fundamental valuations could trigger an alert, signaling potential bubble activity. This proactive approach is a key component of how BI tools help you control bubbles.

Advanced Analytics and Predictive Modeling

Beyond basic reporting, BI tools offer advanced analytical capabilities, such as statistical analysis, predictive modeling, and machine learning. These tools can be used to identify patterns, forecast future trends, and assess the likelihood of a bubble forming. For example, predictive models can analyze historical data to estimate the probability of a price correction based on current market conditions. This predictive power is central to how BI tools help you control bubbles.

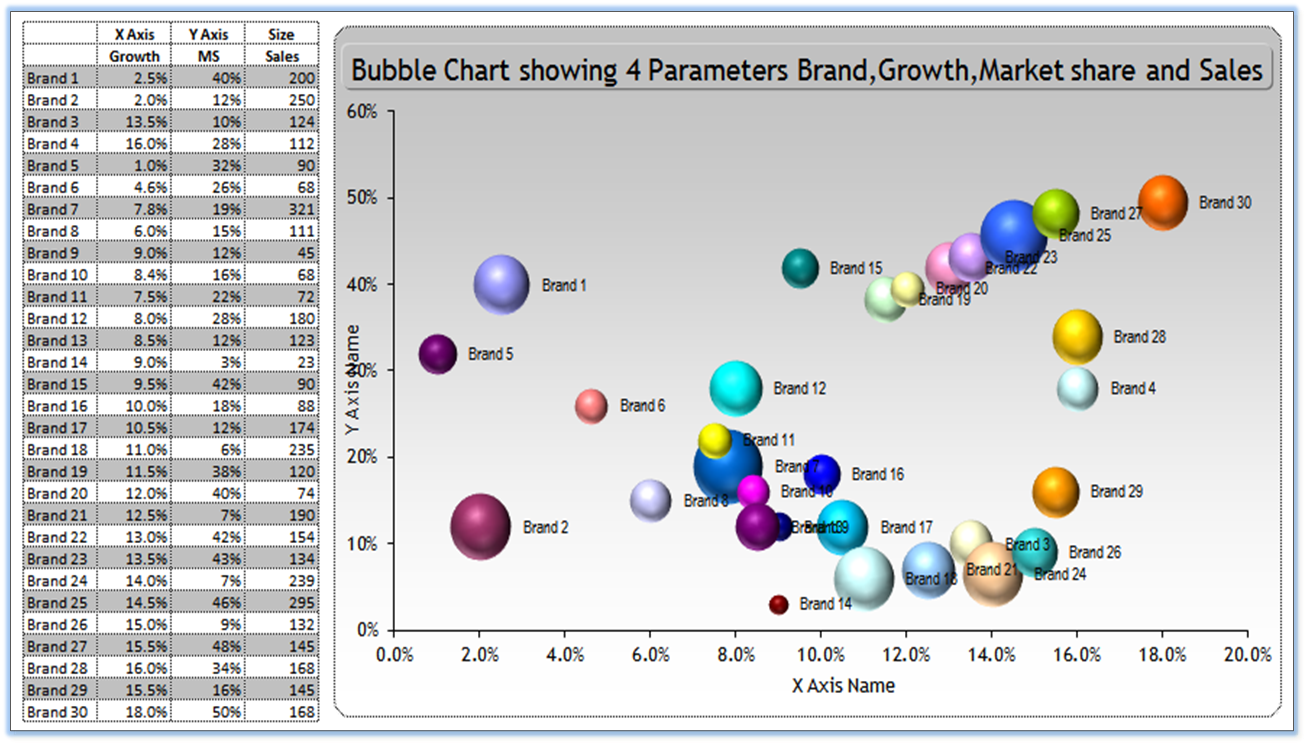

Visualization and Reporting

BI tools transform raw data into easily digestible visualizations, such as charts, graphs, and interactive dashboards. These visualizations provide a clear and concise overview of market trends, making it easier to identify potential risks and communicate findings to stakeholders. Effective visualization is vital for understanding how BI tools help you control bubbles.

Specific Applications of BI Tools in Bubble Control

Let’s explore some specific examples of how BI tools can be used to help you control bubbles in different market contexts:

Stock Market Analysis

BI tools can be used to analyze stock market data, identify overvalued stocks, and assess the overall health of the market. By tracking metrics such as price-to-earnings ratios, debt-to-equity ratios, and insider trading activity, investors can identify companies that may be trading at inflated valuations. This proactive approach is a key factor in how BI tools help you control bubbles in the stock market.

Real Estate Market Analysis

In the real estate market, BI tools can be used to monitor housing prices, interest rates, and inventory levels. By analyzing these factors, investors and policymakers can identify areas where prices are rising rapidly and assess the risk of a housing bubble. Monitoring these indicators is a crucial aspect of how BI tools help you control bubbles in the real estate sector.

Cryptocurrency Market Analysis

The cryptocurrency market is known for its volatility. BI tools can be used to track the prices of different cryptocurrencies, analyze trading volumes, and monitor social media sentiment. This information can help investors identify potential bubbles and make informed decisions. Understanding market sentiment is a critical element of how BI tools help you control bubbles in the cryptocurrency space. [See also: Cryptocurrency Investment Strategies]

Commodities Market Analysis

BI tools can be used to analyze commodity prices, supply and demand dynamics, and geopolitical events that may impact prices. This information can help investors identify potential bubbles in commodities markets, such as oil or gold. This analysis is essential for understanding how BI tools help you control bubbles in the commodities sector.

Implementing BI Tools for Bubble Control: Best Practices

To effectively leverage BI tools for bubble control, consider these best practices:

- Define Clear Objectives: Clearly define the specific goals you want to achieve with BI tools, such as identifying overvalued assets or monitoring market volatility.

- Choose the Right Tools: Select BI tools that are appropriate for your needs and budget, considering factors such as data integration capabilities, analytical features, and visualization options.

- Develop a Robust Data Strategy: Ensure you have access to reliable and relevant data sources and establish a data governance framework to ensure data quality and accuracy.

- Build a Skilled Team: Invest in training and development to build a team of analysts and data scientists who can effectively use BI tools to analyze data and generate insights.

- Monitor and Iterate: Continuously monitor the performance of your BI tools and make adjustments as needed to improve their effectiveness.

The Future of BI Tools in Market Risk Management

As markets become increasingly complex and data-driven, the role of BI tools in market risk management will only continue to grow. Advancements in artificial intelligence and machine learning are poised to further enhance the analytical capabilities of BI tools, enabling more accurate predictions and proactive risk management. The future of how BI tools help you control bubbles lies in their ability to process vast amounts of data, identify subtle patterns, and provide actionable insights in real-time. The ongoing evolution of BI tools promises to be a critical asset in helping you control bubbles in the years to come.

Conclusion: Harnessing the Power of BI Tools

In conclusion, Business Intelligence tools provide a powerful framework for understanding and managing market volatility. They help you control bubbles by providing the analytical capabilities needed to identify risks, make informed decisions, and navigate the complexities of the financial landscape. By embracing BI tools and following best practices, investors, businesses, and policymakers can better protect themselves from the devastating consequences of market bubbles. The ability of BI tools to help you control bubbles is an invaluable asset in today’s challenging market.